The HTS Code (Harmonized Tariff Schedule Code) is a 10-digit number used by U.S. Customs and Border Protection (CBP) to classify imported goods and determine the duties, tariffs, and regulations that apply to them.

It is based on the Harmonized System (HS), an internationally standardized system maintained by the World Customs Organization (WCO), but the U.S. adds additional digits for more specific classification.

Why Is the HTS Code Important?

🏷️ Determines Import Duties: The HTS code directly affects how much duty (tax) you will pay on imported goods.

🛂 Ensures Compliance: Using the wrong code can lead to customs delays, fines, or even seizure of goods.

📦 Affects Other Regulations: Certain HTS codes may be tied to additional requirements (e.g., FDA, USDA, EPA regulations).

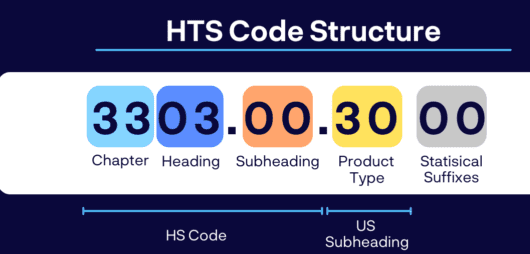

HTS Code Structure (U.S.)

Example: 6109.10.0012

6109 – Shirts and blouses, knitted or crocheted (4-digit HS heading)

10 – Made of cotton (6-digit HS subheading)

00 – Additional U.S. classification detail

12 – Most specific level for statistical and duty purposes

How to Find the Correct HTS Code

Use the U.S. International Trade Commission (USITC) website:

https://hts.usitc.gov

Search by product keyword or description

Consult a customs broker if unsure — classification errors can be costly.

✅ Final Tip:

Always ensure your product is classified correctly. An accurate HTS code is the foundation of compliant and cost-effective importing into the United States.